|

FINANCING |

Maine has a net metering law in place that credits the customer the full

retail value of the electricity they export to the grid. So if we were

to install a system that generated all of the electricity that we need

then our annual bill would be reduced to the minimum connection fee of

around $12.00/month. In fact it is more prudent to undersize the system

so that we would not be giving away any surplus - the utility does not

pay for a surplus, just credits for the excess generated power generated

in any given month.

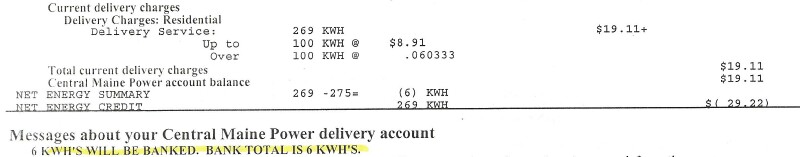

Below is my bill from Central Maine Power for March/April 2012 - using

26 panels (about 4.0kW peak AC power):

Note that since all net metering bills are hand processed, they actually

highlighted my credit for me!

I looked up the last 12 months of our electric bills and then

calculated the

anticipated energy production for a system comprising 21 175-Watt

panels and from this determined what our electric bill would be on a

monthly basis. As you can see below our average bill will be much

lower.

The way that net metering works is that we would bank any surplus credit

in the summer and use it in the winter. As we eventually add more

panels, the credit will be greater.

(You can see how my installation is performing compared to the

estimated solar power on the Real Time

Stats page of this blog.)

My (now ex-wife) and I began by looking into re-financing our house to lock in a low rate

during the "economic downturn" (depression) in March 2009. We had an

ARM mortgage with a MegaBank that would go from the fixed to adjustable

rate next year (2010) and we figured that it was a good time to lock in

a 20 year fixed mortgage. We also decided to go to our local bank for

the re-fi to keep the money in the local economy. I watched the

economic indicators and published mortgage rates carefully and then

locked in the loan rate at the lowest point in the cycle in late May.

We originally budgeted $26,000 for 27 panels that would fill the roof,

but decided to reduce our initial overhead and scale the design back to

a more prudent 21 panels. (Panel prices have dropped significantly

since 2009 and in 2015 are over 50% lower due to the Chinese jumping

into the market with massive government subsidies and decimating the US

manufacturing capacity by dumping their cheaper products). By asking

for an additional $21,000 on the re-financing we were able to lock in a

very attractive rate that works out better than an equity loan or line

of credit.

We determined that the added $21K on our loan would cost us about $180

more per month over 20 years than what we were currently paying. When

we account for the fact that our electric bill will drop from an average

of $100/month (for Clean Power at 18cents/kWh) to about an average of

$58.00/month, so I estimated that our monthly budget would only increase

by an average of $122 ($89 to $146 depending on the seasonal solar gain

-- see below). This is not an undue burden for us. After the loan is

paid off it's all positive cash flow!

(after adding more panels our net bill

in the spring of 2012 was negative - until we purchased a

Chevy Volt electric vehicle.)

The Federal Residential

Energy Efficient Property Credit (form

5695) allows us to deduct 30% of the cost of the system from our

taxes, so we will avoid paying around $7000 in taxes.

Click here for more info on how to file this form. And

click here to learn more about the tax credit.

Maine's

Efficiency Maine program had a

Solar Rebate program, Solar PV systems qualify for rebates of

$2.00/watt for the first 1,000 watts, capped at $2,000. Check the

DSIRE database of

state incentives to learn what you can expect in your state.

|

Update on tax breaks:

We got our taxes done by our accountant in 2010, and got a nasty

surprise. I had thought we would get the full $6185 off our taxes

(on form 5695 - Residential Energy Efficient Property Credit) which

gives a 30% tax credit, but all we got was $1772 with a carry forward

credit of $4413 that applies for 5 years. This is because we are both

self employed (filing jointly) and have to pay a lot of self-employment

tax. So this may not be an issue for "regular wage earners".

Click here to learn more about the 30% tax break.

However we did get the full $2000 Maine Solar rebate. That program

had run out of funds just before we committed to our system, but then it

was re-funded by the Federal Stimulus deal - just in time for me to be

the first to file for the refund!

So here's how our net system cost works out to date:

| Estimated system cost |

$20,615 |

| 30% Federal Tax break

(2009) |

-$1,772 |

| 30% Federal Tax break

(2010) |

-$3,684 |

| 30% Federal Tax break

(2011) |

-$1,582 |

| 30% Federal Tax break

(2012) |

-$287 |

| Maine Solar Rebate |

-$2,000 |

| Net system cost |

$11,290* |

*Note that our total federal tax break add up to $7038 because we

continued to

add panels to the system and got credits each year we added

panels. |

October 2016 Update:

Costs of the equipment have dropped significantly and the break even

point is within 10 years - assuming 100% financing at less than 5%. My

original panels cost $3.29/Watt, but the 245Watt panel I added in

October 2016 cost $0.41/Watt (thanks to a special deal from a friend) - much more affordable.

This tool from

SolarEstimate.org

can help you look at costs and return on investments. Below is my

panel purchase history - I always looked for the very best deal I could

find within reasonable driving distance (to save on shipping costs)

while also staying with US made components as much as practical.

You can use this

Free Solar Panel Price Survey to research the lowest currently

available panel prices.

|

|

|